Depreciation Rate For Household Items . Did you know that furniture loses half its value in just two years? access a comprehensive database of depreciation rates for 580 items across 42 categories. it might be helpful to consult with a professional appraiser or use a more personalized approach to determine the. Select any item to use our. our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a. Depreciation is a term used in accounting to describe the cost of using an asset over a period of time. what is depreciation? It is the set percentage value or rate at which an item loses its value. This fact shows how vital it is to grasp. the depreciation rate tells you how much the appliance depreciate each year.

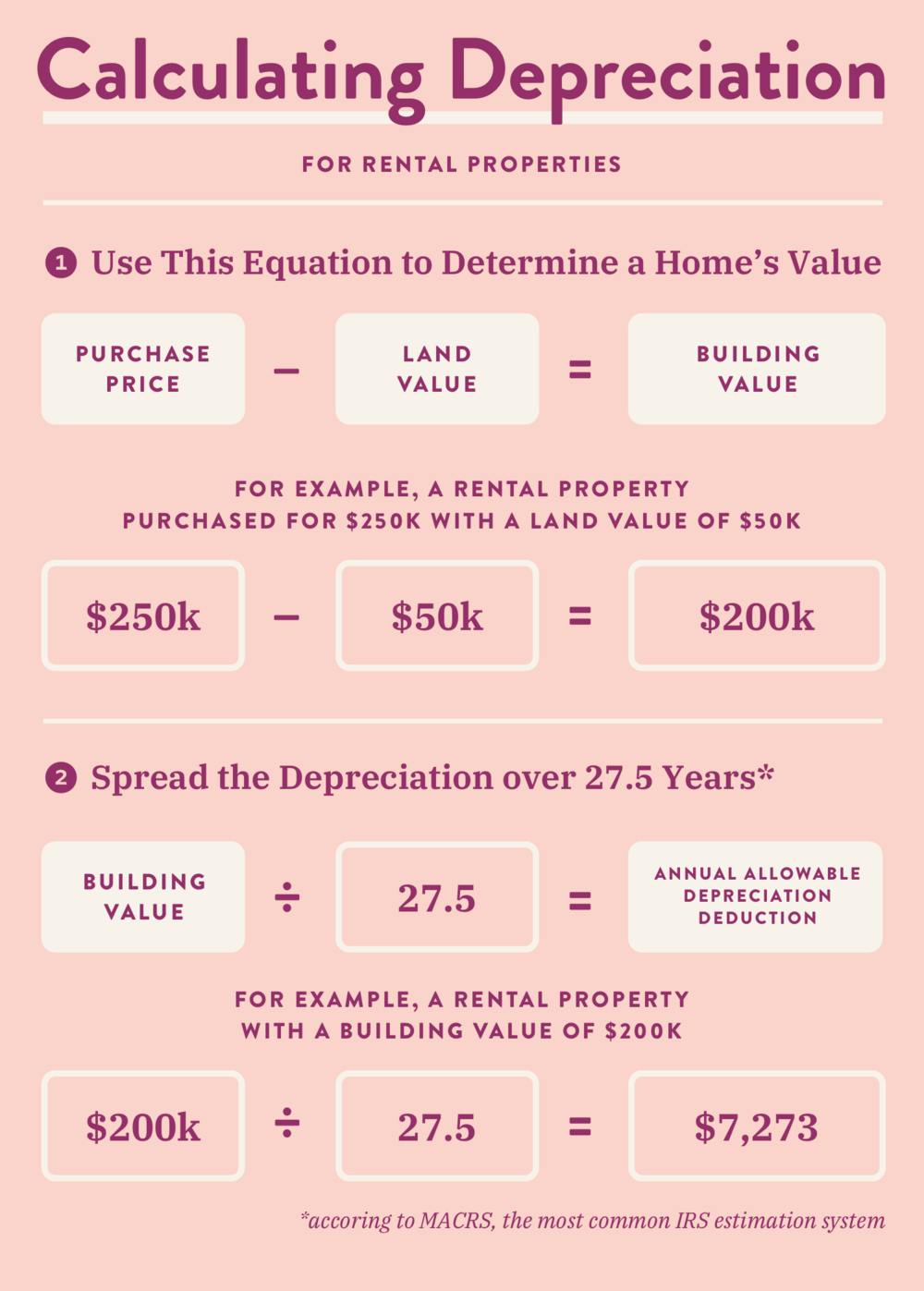

from wealthfit.com

Depreciation is a term used in accounting to describe the cost of using an asset over a period of time. the depreciation rate tells you how much the appliance depreciate each year. It is the set percentage value or rate at which an item loses its value. it might be helpful to consult with a professional appraiser or use a more personalized approach to determine the. This fact shows how vital it is to grasp. Select any item to use our. what is depreciation? our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a. access a comprehensive database of depreciation rates for 580 items across 42 categories. Did you know that furniture loses half its value in just two years?

How to Deduct Rental Property Depreciation WealthFit

Depreciation Rate For Household Items Depreciation is a term used in accounting to describe the cost of using an asset over a period of time. our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a. it might be helpful to consult with a professional appraiser or use a more personalized approach to determine the. Depreciation is a term used in accounting to describe the cost of using an asset over a period of time. It is the set percentage value or rate at which an item loses its value. Did you know that furniture loses half its value in just two years? what is depreciation? This fact shows how vital it is to grasp. access a comprehensive database of depreciation rates for 580 items across 42 categories. the depreciation rate tells you how much the appliance depreciate each year. Select any item to use our.

From napkinfinance.com

What is Depreciation? Napkin Finance Depreciation Rate For Household Items This fact shows how vital it is to grasp. Depreciation is a term used in accounting to describe the cost of using an asset over a period of time. It is the set percentage value or rate at which an item loses its value. it might be helpful to consult with a professional appraiser or use a more personalized. Depreciation Rate For Household Items.

From dxoumrioi.blob.core.windows.net

How To Calculate Depreciation Rate For Rental Property at Arnold Depreciation Rate For Household Items our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a. Depreciation is a term used in accounting to describe the cost of using an asset over a period of time. This fact shows how vital it is to grasp. Did you know that furniture loses half its value in just. Depreciation Rate For Household Items.

From owlcation.com

Methods of Depreciation Formulas, Problems, and Solutions Owlcation Depreciation Rate For Household Items This fact shows how vital it is to grasp. Depreciation is a term used in accounting to describe the cost of using an asset over a period of time. what is depreciation? Did you know that furniture loses half its value in just two years? the depreciation rate tells you how much the appliance depreciate each year. It. Depreciation Rate For Household Items.

From www.double-entry-bookkeeping.com

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping Depreciation Rate For Household Items what is depreciation? Depreciation is a term used in accounting to describe the cost of using an asset over a period of time. This fact shows how vital it is to grasp. our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a. Select any item to use our. . Depreciation Rate For Household Items.

From haipernews.com

How To Calculate Depreciation On Household Items Haiper Depreciation Rate For Household Items access a comprehensive database of depreciation rates for 580 items across 42 categories. the depreciation rate tells you how much the appliance depreciate each year. This fact shows how vital it is to grasp. what is depreciation? It is the set percentage value or rate at which an item loses its value. Depreciation is a term used. Depreciation Rate For Household Items.

From www.fastcapital360.com

How to Calculate MACRS Depreciation, When & Why Depreciation Rate For Household Items access a comprehensive database of depreciation rates for 580 items across 42 categories. This fact shows how vital it is to grasp. Did you know that furniture loses half its value in just two years? Select any item to use our. our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset. Depreciation Rate For Household Items.

From thirdspacelearning.com

Depreciation GCSE Maths Steps, Examples & Worksheet Depreciation Rate For Household Items Select any item to use our. It is the set percentage value or rate at which an item loses its value. Did you know that furniture loses half its value in just two years? access a comprehensive database of depreciation rates for 580 items across 42 categories. the depreciation rate tells you how much the appliance depreciate each. Depreciation Rate For Household Items.

From www.youtube.com

Lesson 7 video 3 Straight Line Depreciation Method YouTube Depreciation Rate For Household Items the depreciation rate tells you how much the appliance depreciate each year. Select any item to use our. access a comprehensive database of depreciation rates for 580 items across 42 categories. our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a. Depreciation is a term used in accounting. Depreciation Rate For Household Items.

From dxoumrioi.blob.core.windows.net

How To Calculate Depreciation Rate For Rental Property at Arnold Depreciation Rate For Household Items Select any item to use our. This fact shows how vital it is to grasp. access a comprehensive database of depreciation rates for 580 items across 42 categories. Did you know that furniture loses half its value in just two years? our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset. Depreciation Rate For Household Items.

From www.templateroller.com

Asset Depreciation Calculator Spreadsheet Template Download Printable Depreciation Rate For Household Items access a comprehensive database of depreciation rates for 580 items across 42 categories. Select any item to use our. our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a. This fact shows how vital it is to grasp. It is the set percentage value or rate at which an. Depreciation Rate For Household Items.

From www.slideteam.net

Calculation Of Depreciation On Fixed Assets Depreciation Expense Ppt Depreciation Rate For Household Items Did you know that furniture loses half its value in just two years? It is the set percentage value or rate at which an item loses its value. Select any item to use our. access a comprehensive database of depreciation rates for 580 items across 42 categories. our smart depreciation calculator lets you compute the yearly depreciation and. Depreciation Rate For Household Items.

From marketbusinessnews.com

What is depreciation? Definition and examples Market Business News Depreciation Rate For Household Items our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a. what is depreciation? access a comprehensive database of depreciation rates for 580 items across 42 categories. Did you know that furniture loses half its value in just two years? it might be helpful to consult with a. Depreciation Rate For Household Items.

From www.calt.iastate.edu

Using Percentage Tables to Calculate Depreciation Center for Depreciation Rate For Household Items our smart depreciation calculator lets you compute the yearly depreciation and determine the value of an asset after a. Did you know that furniture loses half its value in just two years? what is depreciation? This fact shows how vital it is to grasp. access a comprehensive database of depreciation rates for 580 items across 42 categories.. Depreciation Rate For Household Items.

From www.researchgate.net

Depreciation rate and home vs. foreign interest rate spread Download Depreciation Rate For Household Items access a comprehensive database of depreciation rates for 580 items across 42 categories. it might be helpful to consult with a professional appraiser or use a more personalized approach to determine the. It is the set percentage value or rate at which an item loses its value. our smart depreciation calculator lets you compute the yearly depreciation. Depreciation Rate For Household Items.

From atikkmasroaniati.blogspot.com

Irs home depreciation calculator Atikkmasroaniati Depreciation Rate For Household Items it might be helpful to consult with a professional appraiser or use a more personalized approach to determine the. This fact shows how vital it is to grasp. Did you know that furniture loses half its value in just two years? Depreciation is a term used in accounting to describe the cost of using an asset over a period. Depreciation Rate For Household Items.

From www.online-accounting.net

Straight Line Depreciation Method Online Accounting Depreciation Rate For Household Items the depreciation rate tells you how much the appliance depreciate each year. Select any item to use our. access a comprehensive database of depreciation rates for 580 items across 42 categories. It is the set percentage value or rate at which an item loses its value. what is depreciation? Did you know that furniture loses half its. Depreciation Rate For Household Items.

From businessfirstfamily.com

Popular Depreciation Methods To Calculate Asset Value Over The Years Depreciation Rate For Household Items Select any item to use our. access a comprehensive database of depreciation rates for 580 items across 42 categories. This fact shows how vital it is to grasp. the depreciation rate tells you how much the appliance depreciate each year. Did you know that furniture loses half its value in just two years? our smart depreciation calculator. Depreciation Rate For Household Items.

From wealthfit.com

How to Deduct Rental Property Depreciation WealthFit Depreciation Rate For Household Items access a comprehensive database of depreciation rates for 580 items across 42 categories. It is the set percentage value or rate at which an item loses its value. what is depreciation? This fact shows how vital it is to grasp. Select any item to use our. Depreciation is a term used in accounting to describe the cost of. Depreciation Rate For Household Items.